President Joe Biden is still reportedly mulling whether to cancel up to $10K in student debt per borrower, a plan that, as we have pointed out in the past, would mostly benefit the Democrats’ wealthier, college-educated voters.

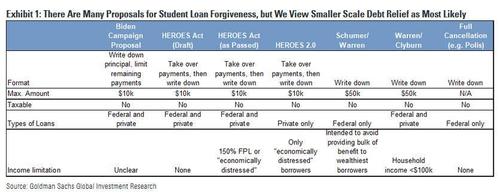

In Congress, several plans were kicked around earlier his year before President Biden’s $1.9 trillion stimulus was ultimately passed. But analysts at Goldman Sachs believe a more scaled-down plan is the most likely. With the moratorium on student loan payments set to expire on Oct. 1, a critical headwind that has allowed (mostly middle-class) Americans to bolster their savings substantially.

According to Bloomberg, “there’s an unwelcome side of the return of business-as-usual after the pandemic: They’ll have to start repaying their student loans again.”

“More than 40 million holders of federal loans are due to start making monthly installments again on Oct. 1, when the freeze imposed as part of Covid-19 relief measures is due to run out. It covered payments worth about $7 billion a month, the Federal Reserve Bank of New York estimated. Their resumption will eat a chunk out of household budgets, in a potential drag on the consumer recovery.”

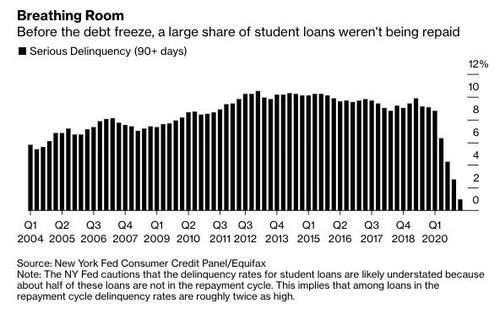

The problem is that even before the pandemic started, Americans were starting to slack on their student loan payments. In a sense, politicians were fortunate when COVID-19 hit, if only because it gave the government cover to impose the moratorium.

Source: Bloomberg

Politicians already recognize that America’s student debt burden is already unsustainable. Of the government’s $1.7 trillion student loan portfolio, almost one-third is unpaid. That $435 billion is comparable to the $535 billion that private lenders lost on subprime mortgages during the 2008 financial crisis.

Continue Reading: zerohedge.com

Leave a Reply