Authored by Austin Alonzo via The Epoch Times (emphasis ours),

Although President-elect Donald Trump and the Republican Party swept the 2024 general election, the cryptocurrency industry feels it is the real winner.

Powered by donations from some of the biggest figures in cryptocurrency and venture capital, three political action committees poured more than $100 million into efforts to influence the 2024 election.

“This election was a huge win for crypto,” co-founder and CEO of Coinbase Global Inc. Brian Armstrong wrote on Nov. 7 in an article on X.

Coinbase, a cryptocurrency exchange founded in 2012, donated about $55 million to the super PAC Fairshake, according to Federal Election Commission records. Armstrong personally donated $1 million.

As Armstrong wrote, the industry had much to celebrate in early November. It saw its preferred candidates take the White House and win key seats in both houses of Congress. He declared that the 119th Congress will be the “most pro-crypto Congress ever.”

In his message, Coinbase’s leader wrote something that is usually implied but rarely said in the world of political spending, too.

“[Washington] received a clear message that being anti-crypto is a good way to end your career,” Armstrong said.

10 Cents to $89,000

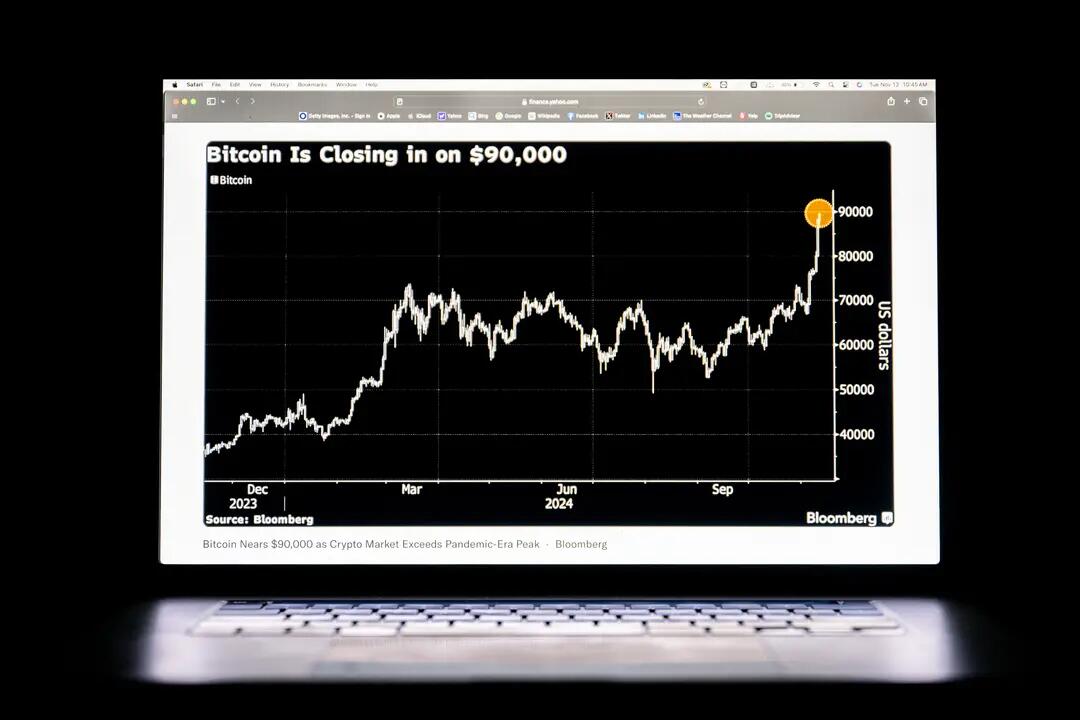

Twenty years ago, few people had heard of cryptocurrency—a term used to refer to decentralized digital currencies as opposed to central bank digital currencies (CBDCs) that are controlled and backed by a government or central bank. One week after the Nov. 5 election, a Bitcoin was trading for more than $89,000. Gold, by comparison, traded for about $2,600 an ounce on the same day.

Between 2007 and 2009, a person or group known as Satoshi Nakamoto conceived of and launched Bitcoin. It was a new type of digital money secured via encryption technology. Unlike traditional currency, Bitcoin can transfer value online without a bank or a payment processor. It is not backed by any government, central bank fiat currency, or physical asset.

Bitcoin began as an obscure novelty worth less than 10 cents per token. However, its price has exploded in the last decade, creating significant public interest in the digital asset. According to the crypto website Coinranking, as of Nov. 13, Bitcoin’s market capitalization was about $1.83 trillion.

Nevertheless, public opinion polling shows that a majority of Americans are not confident in cryptocurrency as an investment. A Pew Research Center study published in October found that just 5 percent of the people it surveyed in February said they were “very” or “extremely” confident in the reliability and safety of cryptocurrency.

The same report found that 17 percent of Americans have ever invested in, traded, or used a cryptocurrency. As an investment, about 38 percent of respondents said cryptocurrency has done “worse than expected.”

Rick Claypool, the research director in the president’s office of Public Citizen, told The Epoch Times that cryptocurrency, generally, is an extremely volatile investment vehicle without any intrinsic value—one that is now very risky for the average investor.

Public Citizen, founded in 1971, is a nonprofit consumer advocacy organization. In May, it published a report describing the cryptocurrency industry’s investment in politics as part of a “strategy of combating enforcement crackdowns and designing a regulatory system that meets the industry’s specifications.”

Regulators Take Aim

The growing use of cryptocurrency over the last decade, and concern about the consumer risks, has led to a rush to begin regulating the fast-growing industry.

The swift rise and fall of Sam Bankman-Fried and his cryptocurrency exchange FTX highlighted the potential for fraud in a lightly regulated sector of the economy.

In March, Bankman-Fried was sentenced to 25 years in prison and ordered to pay $11 billion in forfeiture for what the U.S. Department of Justice called his “orchestration of multiple fraudulent schemes.” Bankman-Fried was accused of stealing more than $8 billion of his customer’s money through FTX and Alameda Research, a cryptocurrency trading firm he founded.

Bankman-Fried was initially arrested in the Bahamas and extradited to the United States, where he was charged with multiple fraud offenses, in December 2022. FTX collapsed in November 2022.

A year earlier, Securities and Exchange Commission chairman Gary Gensler asked the Senate’s Banking Housing and Urban Affairs Committee for additional resources to begin addressing regulatory concerns surrounding the cryptocurrency industry. In that testimony, he said the entire crypto asset class was “rife with fraud, scams, and abuse.”

Under Gensler, who was appointed commissioner by President Joe Biden in April 2021, the SEC views most crypto assets as securities. Since 2022, the SEC has charged multiple firms with violating federal securities law by offering and selling unregistered securities.

As recently as Oct. 9, when he appeared at a conference at the New York University School of Law, Gensler said he continues to view the crypto industry as a hotbed of “fraudsters,” “grifters,” and “scams.”

Gensler’s actions made him the crypto industry’s top political enemy, Claypool said.

Election Targets

In 2024, the industry began spending on political causes through three linked committees: Fairshake, Defend American Jobs, and Protect Progress. Claypool said while these PACs were founded and funded by crypto, none of the advertisements and political messaging they paid for said anything about cryptocurrency or a candidate’s positions on financial regulations.

Continue Reading: zerohedge.com

Leave a Reply