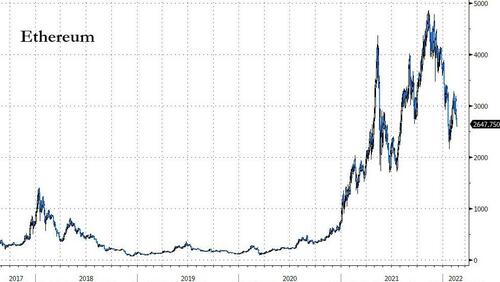

It has not been a good few months from the crypto world. After rampaging higher during the middle of last year, cryptocurrencies have broadly speaking dropped around 40-50% since their November highs, and have become more and more correlated with the traditional financial system as long-duration, hyper-growth companies have seen their share prices decimated by the realization that ‘this time is serious’ from The Fed on their policy-tightening plans.

And while 98-year-old curmudgeons are busily saying cryptos are “like some venereal disease … I just regard it as beneath contempt,” the rest of the tech world is beavering away envisioning – and creating – web3 – the decentralized new internet.

The current drawdown is painful for some, and prompts yet more pronouncements from the establishment that ‘cryptos are dead’, Bloomberg reports that Vitalik Buterin, co-founder of the Ethereum blockchain, says the digital-asset universe may actually benefit from the current retreat in coin prices that’s cast a chill on investors and is being referred to as another crypto winter.

“The people who are deep into crypto, and especially building things, a lot of them welcome a bear market,” Buterin said during an interview with Bloomberg.

“They welcome the bear market because when there are these long periods of prices moving up by huge amounts like it does — it does obviously make a lot of people happy — but it does also tend to invite a lot of very short-term speculative attention.”

Buterin said in a recent statement that he believes Ethereum can become a world computer after becoming a more efficient base layer for applications, and now is the time for that to escalate.

“The winters are the time when a lot of those applications fall away and you can see which projects are actually long-term sustainable, like both in their models and in their teams and their people.

The 28-year-old crypto billionaire remains bullish on Ethereum and notes that the eventual convergence of Proof of Stake (PoS) and the Ethereum application layer is crucial.

Yet Buterin, who said he’s “surprised” by how the market has moved since last year, isn’t sure whether crypto has entered another winter or the sector is just mirroring the volatility in broader markets.

“It does feel like the crypto markets kind of flip the switch from being this niche group that’s controlled by a very niche group of participants and it’s fairly disconnected to traditional markets into something that behaves more and more like it is part of the mainstream financial markets,” he said from Denver on Feb. 12.

Mike Novogratz’s Galaxy Digital is reportedly accelerating its pace of hiring to capitalize on a boom of talent that is still shifting into digital assets, and as if right on cue, Buterin noted in a very recent interview, the Canadian government’s decision to invoke the Emergencies Act – in an attempt to restrict the flow of funds to truck drivers protesting the country’s COVID restrictions – show why cryptocurrencies exist.

As cryptovib.com reports, in an interview held at the ETHDenver conference, Buterin, who grew up in Canada, described the government’s response to the protests as extreme, saying that cryptocurrencies offer a safeguard against such extremism:

“If the government isn’t willing to enforce the law… [and]gives people a chance to defend themselves… and they just want to talk to the banks and basically cut people’s livelihoods without due process, that’s is an example of how decentralized technology exists to make this kind of extremism difficult.”

Buterin says cryptocurrencies are not radical, but corrective, emphasizing the danger of using banks to stop protesters:

“It’s not about being illegal. In a way, it’s about restoring the rule of law. Governments and police can still act legally and go after suspects “as usual” without commissioning financial intermediaries… The idea of going after intermediaries and using intermediaries for all this is dangerous.”

Coming full circle, back to Charlie Munger’s mumbling rant, he did note one thing that was drastically under-reported by the mainstream media…

Munger says “inflation is a very serious subject. You can argue that it’s the way democracies die… If you overdo it, you can ruin your civilization, so it’s a long-range danger.”

“The safe assumption for investors is that over the next 100 years, the [fiat]currency is going to zero… that’s my working hypothesis.”

And in a not ironic way at all we suggest to Buffett’s boy-wonder: “crypto solves that.”

Source: Zerohedge.com

Leave a Reply