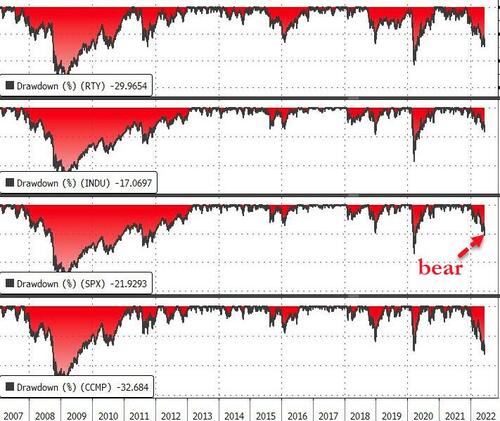

Well that escalated quickly. Apart from crude oil, almost all asset classes were clubbed like baby seals today as event risk anxiety (ahead of FOMC) combined with OpEx technicals ($3.4 trillion options expiration) and European ‘fragmentation’ fears and all the usual geo-political, geo-economic factors that are holding back the dip-buyers as the S&P drops into a bear market and US equities broadly test 2022 lows (while TSY yields push multi-year highs).

The S&P closed down 22% from its highs and at its lowest since Jan 2021…

“…millions of voices suddenly cried out in terror and were suddenly silenced…”

As Bill Blain noted earlier, the summer somnambulance should be upon us – investment desks and traders sitting back to watch their carefully composed portfolios and positions cruise through the summer before the markets get hot again in September. At least, that’s how I remember the long-balmy days of my market childhood back when I was a young banker….

Not this year. Too many fundamental tremblors threaten to rock the markets:

- Inflation, Inflation, Inflation

- Supply Chains, Covid and China

- Europe and the ECB

- Recession/stagflation

- War vs Jaw

- Central Banks tightening

- Stock Resets and Earnings

- Bond Market Meltdown

- Global Trade Reset and De-Globalisation

- The US, The Dollar and Trump

I predict a stormy Q3 – the usually calm languid dog-day markets of July and August being replaced by lumpy seas of bad numbers, grey storm skies as markets struggle with the acceleration of negative news-flow on inflation, corporate earnings, markets and increasingly wobbly politics, and few sharp pointy rocks of financial destruction.

Financial Conditions are tightening once again, ratcheting down as The Fed stomps on the brake, surveys the damage, lifts off briefly, then re-stomps on the brake…

Source: Bloomberg

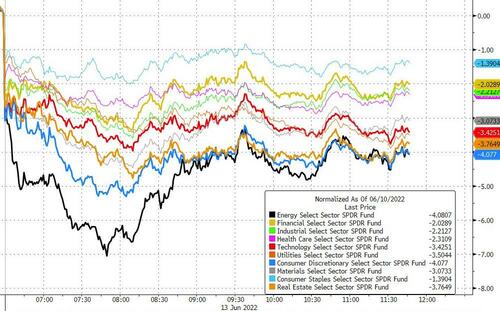

Recession risks are rising as signaled by Energy, Consumer Discretionary, and Materials all lagging a sharply down market. And on the too-high inflation and higher rates side of the pendulum, Real Estate and Tech are also selling off today.

Source: Bloomberg

US equity markets were notably weaker overnight and extended losses at the open. The European close – and the end of BTP selling – sparked some relief that sent crypto and US stocks higher but the algos could not build on it. Witho about 30 minutes to go a major sell order hit all the markets – bonds and gold were dumped and stocks pushed to the lows of the day. Dow -3%, S&P -5%, Nasdaq -4.6%, Small Caps -5%

The last time the S&P had a 4-day stretch this bad (-1.08%, -2.38%, -2.91%, -3.23%) was March 23, 2020 when the Fed unleashed $1 trillion in QE, repo and corporate bond purchases

And some context for the move in the last 3 days…

2017 biggest drawdown: 3%

2021 biggest drawdown: 5%$SPY -8% last 3 days. pic.twitter.com/vMlcYKnwLJ— Mike Zaccardi, CFA, CMT (@MikeZaccardi) June 13, 2022

The market cap of FANG stocks has no plunged to ‘just’ $3 trillion (it was at $5.11 trillion on 11/18/21)…

Continue: zerohedge.com

Leave a Reply